The Dow Theory is one of the most used concepts of technical analysis of the stock markets and includes aspects of sector rotation. This theory is named after American journalist Charles Henry Dow who is famous for co-founding Dow Jones & Company with Edward Jones and Charles Bergstresser. Though published more than one hundred years ago, this theory still remains one of the pillars of technical research as far as the stock markets are concerned.

The Six Assumptions :

The Dow Theory is studied by investors and market analysts based on six major assumptions or tenets that they are offer referred to as

-

The Averages Discount Everything

As per this assumption a stock’s price reflects everything that is known about it. Whenever there is some new information about the stock it quickly disseminates among the participants and the prices adjust accordingly. This theory also takes into account unpredictable events, such as earthquakes and other natural calamities that determine the prices of the stock.

-

The Market Has Three Trends

There are three forces that affect the market – the Primary trend, Secondary trends, and Minor trends. The Primary trend can occur in both bullish (rising) market and a bearish (falling) market. This trend usually lasts for a year or more and pushes the market to higher-highs and higher-lows. Secondary trends are intermediate and mostly corrective to the Primary trend and last between one or three months. Minor trends last one day or a few weeks and this can often be misleading.

-

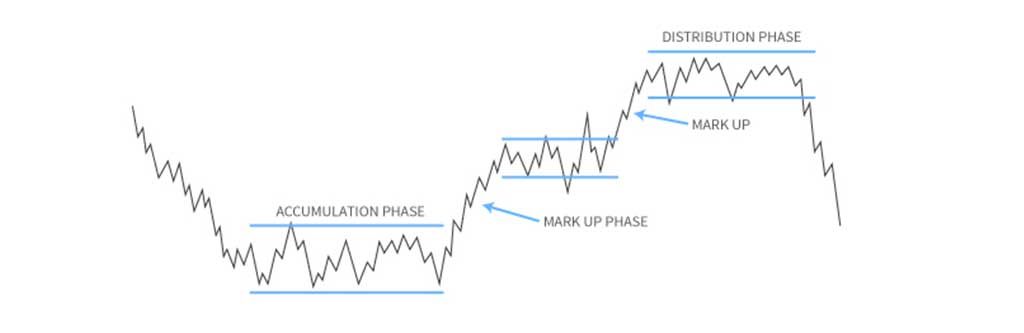

Market Trend Has Three Phases

Here Dow talked about the primary trend and said that it has three phases – accumulation phase, public participation phase and distribution phase. In the accumulation phase astute investors put in the money after a gloomy market in the hope of earning quality returns. Next comes the public participation phase where trend-followers to participate and lead to advances in prices. In the distribution phase speculative volumes rise and public participation increases. It is here that astute investors begin to distribute or sell before anyone else starts selling.

-

The Averages Must Confirm Each Other

According to Dow both the Industrial and Transport averages must give the same signal for a valid change of trend to occur. What he meant was that bull or bear market signals cannot occur unless both the averages are pointing towards the same trend.

-

The Volume Confirms the Trend

Volume according to this theory is a secondary but important factor that confirms uncertain situations. To put this thing into perspective the volume of the stock should move towards the direction of the primary trend. In an uptrend volume should decrease as the prices go up where as in a downtrend the volume should increase as the prices fall.

-

A Trend Remains Intact Until It Gives a Definite Reversal Signal

This can be explained by the theory that a trend would continue in the direction until some external forces causes it to change direction. Whenever a reversal of the trend occurs it would give a definitive signal.